Most people say that it is the intellect which makes a great scientist. They are wrong: it is character. – Albert Einstein

US CLOs: MVOC (Investment-Grade)

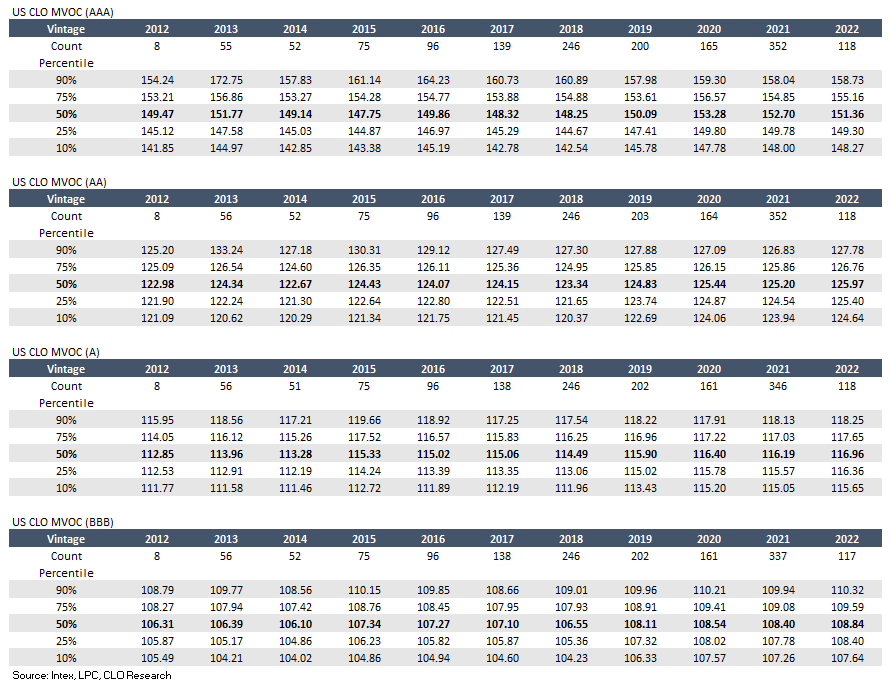

The tables below show the MVOC metrics of US BSL CLO deals* by vintage based on asset prices as of 8 Sep 2022.

CLO MVOC (AAA–BBB)

Market Value Over-Collateralisation (MVOC), for instance, at the BBB tranche level, is calculated by dividing the collateral MV by the sum of CLO liabilities (AAA to BBB). Market participants focus a lot on this number – a point in time metric – as it is an important metric for pricing CLO-rated tranches. Put another way, CLO-rated tranches do trade on the back of the loan market.

At the senior levels, perhaps the greatest concern is systemic risk rather than idiosyncratic risk. That said, it is essential to note that a CLO collateral pool is very well diversified across many real businesses in various industries. A typical underlying CLO portfolio is comprised of a diverse pool of syndicated bank loans (provided to non-investment grade companies). Some of these companies have a quality business profile, but they are non-investment grade because of their aggressive financial profile.

Default correlations between industries have been very low. Even within the same industry they would not be too high as some companies would benefit when their competitors’ businesses collapsed. Across credit cycles, we have not seen default contagion spanning many industries – typically, only a handful of industries would be badly hit in each downturn.

* Deals with less than 250 million collateral notional outstanding are excluded.

Related articles:

US and EU CLO AUM Breakdown by RI Period

– Over US$200bn of US CLOs and EUR 20bn of EU CLOs would potentially become static if the reset market is not open for business over the next year.

How Does CLO Securitisation Work?

– Have you ever wondered how CLO AAA/AA/A tranche ratings are created from a portfolio of non-investment grade loans?

Understanding The Commonly Used CLO Deal Metrics and Their Limitations

– In the CLO market, it appears that the term ‘CLO performance or resilience’ could carry many meanings. CLO performance or resilience is typically referred to as a CLO deal’s metrics performance (or the resilience of CLO tranche ratings) rather than a CLO’s investment performance. In other words, a CLO tranche could underperform even when their deal metrics are looking good!

Disclaimers

The information, research, data, research-related opinions, observations, and estimates contained in this document have been compiled or arrived at by CLO Research Group, based upon sources believed to be reliable and accurate, and in good faith, but in each case without further investigation. None of CLO Research Group or its service providers; authorised personnel, or their directors make any expressed or implied presentation or warranty, nor do any of such persons accept any responsibility or liability as to the accuracy, timeliness, completeness, or correctness of such sources and the information, research, data, research related opinions, observations and estimates contained in this document. All information, research, data, research-related opinions, observations, and estimates in this document are in draft form as of the date of this document and remain subject to change and amendment without notice. Neither CLO Research Group nor any of their third-party providers shall be subject to any damages or liability for any errors, omissions, incompleteness, or incorrectness of this document. This article is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell securities and shall not be relied upon as a promise or representation regarding the historical or current position or performance of any of the deals or issues mentioned in it.