US and EU CLO BB MVOC by Vintage (as of 25 May 2022)

- Market Value Over-Collateralisation (MVOC) (say, at the BB tranche level) is calculated by dividing the collateral MV by the sum of CLO liabilities (AAA to BB).

- Market participants focus a lot on this number – which is a point in time metric – as it is an important metric for pricing CLO rated tranches. In other words, CLO rated tranches trade on the back of the loan market. CLO BB tranches could also be seen as a levered exposure to the loan market.

The table below shows the MVOC metrics (at the BB-rated tranche level) of US BSL CLO deals* by vintage based on loan prices as of 25 May 2022.

- MVOC metrics look quite stressed today, given the weak loan market.

- 2014 vintage deals have the lowest average MVOC, while 2020 vintage deals have the highest MVOC on average.

- Around 15% of the deals in the sample saw an MVOC ratio of less than 100.

A CLO capital structure is a function of key factors such as the reinvestment period, maturity date, WARF, and diversity score. In other words, the inherent leverage within the CLO capital structure is driven by these factors. An EU CLO structure is typically less levered than a US CLO structure, largely due to the less diversified nature of the underlying collateral pools, among other factors.

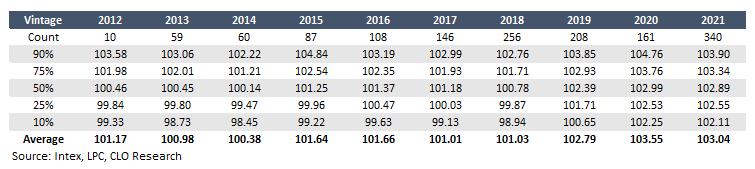

The following table shows the MVOC metrics (at the BB-rated tranche level) of EU CLO deals* by vintage based on loan prices as of 25 May 2022.

- Notably, more seasoned EU CLO deals (2013– 2015 vintage deals) have generally done reasonably well.

- None of the EU CLO deals saw an MVOC ratio of less than 100.

* Deals with less than a 100million collateral notional outstanding are excluded.

Disclaimers

The information, research, data, research-related opinions, observations, and estimates contained in this document have been compiled or arrived at by CLO Research Group, based upon sources believed to be reliable and accurate, and in good faith, but in each case without further investigation. None of CLO Research Group or its service providers; authorised personnel, or their directors make any expressed or implied presentation or warranty, nor do any of such persons accept any responsibility or liability as to the accuracy, timeliness, completeness, or correctness of such sources and the information, research, data, research related opinions, observations and estimates contained in this document. All information, research, data, research-related opinions, observations, and estimates in this document are in draft form as of the date of this document and remain subject to change and amendment without notice. Neither CLO Research Group nor any of their third-party providers shall be subject to any damages or liability for any errors, omissions, incompleteness, or incorrectness of this document. This article is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell securities and shall not be relied upon as a promise or representation regarding the historical or current position or performance of any of the deals or issues mentioned in it.