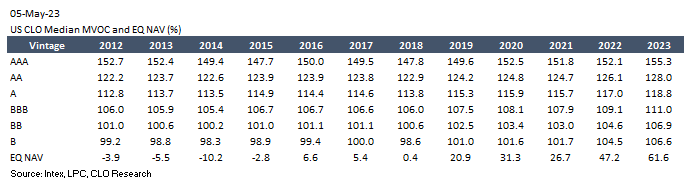

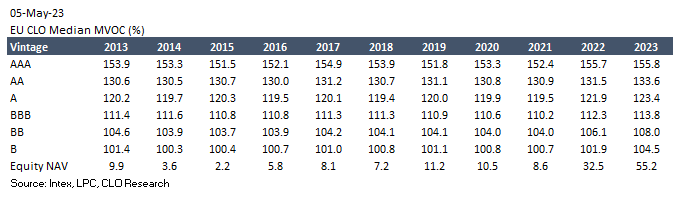

The tables below show the median MVOC and EQ NAV metrics of US BSL CLO and EU CLO deals by vintage, based on asset prices as of 5 May 2023.

MVOC

Market Value Over-Collateralisation (MVOC), for instance, at the BBB tranche level, is calculated by dividing the collateral MV by the sum of CLO liabilities (AAA to BBB).

Market participants in the primary and secondary markets rely heavily on MVOC metrics to price CLO-rated tranches, which means that the performance of the loan market significantly impacts the trading of CLO-rated tranches.

CLO Equity NAV

CLO Equity NAV is calculated by dividing the residual collateral value (MV collateral net of total CLO debt notional) by the equity tranche notional.

* US and EU CLO deals with collateral notional outstanding below USD 250 million and EUR 200 million, respectively, are excluded.

Related articles:

Understanding The Commonly Used CLO Deal Metrics and Their Limitations

EU CLO MVOC and EQ NAV Across All Tranches and Vintages

US CLO MVOC and EQ NAV Across All Tranches and Vintages

Disclaimers

The information, research, data, research-related opinions, observations, and estimates contained in this document have been compiled or arrived at by CLO Research Group, based upon sources believed to be reliable and accurate, and in good faith, but in each case without further investigation. None of CLO Research Group or its service providers; authorised personnel, or their directors make any expressed or implied presentation or warranty, nor do any of such persons accept any responsibility or liability as to the accuracy, timeliness, completeness, or correctness of such sources and the information, research, data, research related opinions, observations and estimates contained in this document. All information, research, data, research-related opinions, observations, and estimates in this document are in draft form as of the date of this document and remain subject to change and amendment without notice. Neither CLO Research Group nor any of their third-party providers shall be subject to any damages or liability for any errors, omissions, incompleteness, or incorrectness of this document. This article is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell securities and shall not be relied upon as a promise or representation regarding the historical or current position or performance of any of the deals or issues mentioned in it.