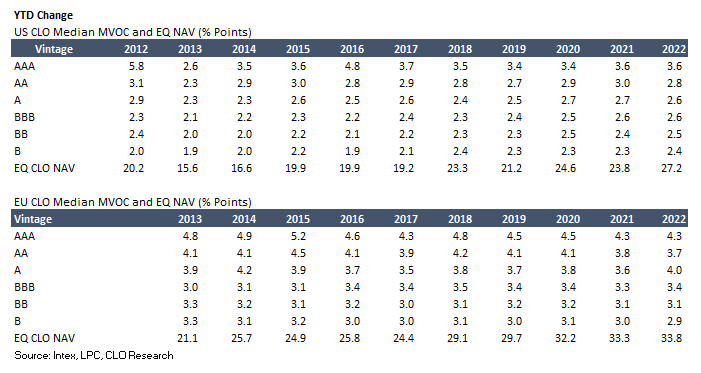

CLO MVOC metrics have all improved considerably across the board YTD (as shown in the tables below). Consequently, CLO debt tranche spreads have tightened significantly on the back of US and EU leveraged loan markets rally.

For the first time in many months, the median CLO equity NAV metrics have turned positive across vintages for both US and EU CLO deals. That said, CLO equity NAV metrics are still not close to a level that would give CLO equity investors a decent final IRR.

For a regular arbitrage CLO deal, a final NAV of over 50% is typically desired to deliver at least a double-digit IRR number for CLO equity investors. Of course, annual distributions must hit at least 15-16% for about five years.

Related articles:

Latest US and EU CLO Median MVOC (AAA–B) and EQ NAV by Vintage

Final Post-2012 US CLO Equity IRRs: NAV vs Annual Distributions

Disclaimers

The information, research, data, research-related opinions, observations and estimates contained in this document have been compiled or arrived at by CLO Research Group, based upon sources believed to be reliable and accurate, and in good faith, but in each case without further investigation. None of CLO Research Group or its service providers; authorised personnel, or their directors make any expressed or implied presentation or warranty, nor do any of such persons accept any responsibility or liability as to the accuracy, timeliness, completeness or correctness of such sources and the information, research, data, research related opinions, observations and estimates contained in this document. All information, research, data, research-related opinions, observations, and estimates in this document are in draft form as of the date of this document and remain subject to change and amendment without notice. Neither CLO Research Group nor any third-party providers shall be subject to any damages or liability for any errors, omissions, incompleteness or incorrectness of this document. This article is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell securities and shall not be relied upon as a promise or representation regarding the historical or current position or performance of any of the deals or issues mentioned in it.