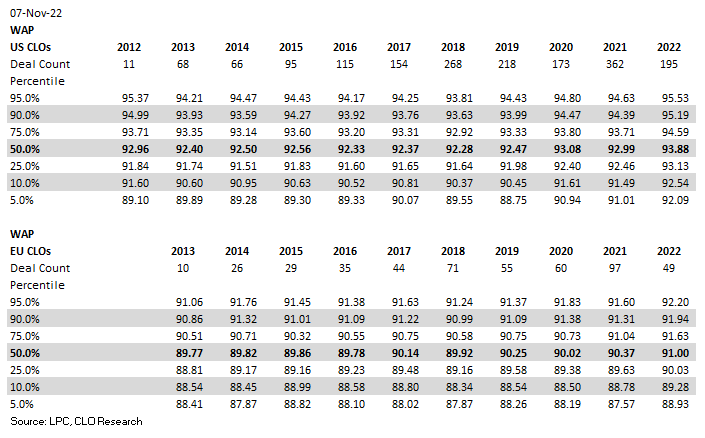

Collateral weighted average price (WAP*) is quite useful for a quick snapshot of collateral credit risks.

That said, this metric has its limitations. First and foremost, WAP could be artificially inflated due to trading. CLO managers may have crystallised portfolio losses by trading out of poorly performing assets. On the other hand, some managers might have built quality par, which could help offset the negative MTM impact. Be that as it may, the quality of each portfolio varies from one deal to another. One has to look at the entirety of the manager’s performance since inception, including the interest performance component and adjustments for the different market conditions. The WAP metric is a point-in-time metric, so it does not measure investment performance over a period of time.

* Cash is included in the calculation

Related (basic premium) articles:

(Featured) EU CLO Managers: Quarterly Relative Standing Based on MV Return Alpha

(Featured) US CLO Managers: Quarterly Relative Standing Based on MV Return Alpha

Disclaimers

The information, research, data, research-related opinions, observations, and estimates contained in this document have been compiled or arrived at by CLO Research Group, based upon sources believed to be reliable and accurate, and in good faith, but in each case without further investigation. None of CLO Research Group or its service providers; authorised personnel, or their directors make any expressed or implied presentation or warranty, nor do any of such persons accept any responsibility or liability as to the accuracy, timeliness, completeness, or correctness of such sources and the information, research, data, research related opinions, observations and estimates contained in this document. All information, research, data, research-related opinions, observations, and estimates in this document are in draft form as of the date of this document and remain subject to change and amendment without notice. Neither CLO Research Group nor any of their third-party providers shall be subject to any damages or liability for any errors, omissions, incompleteness, or incorrectness of this document. This article is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell securities and shall not be relied upon as a promise or representation regarding the historical or current position or performance of any of the deals or issues mentioned in it.