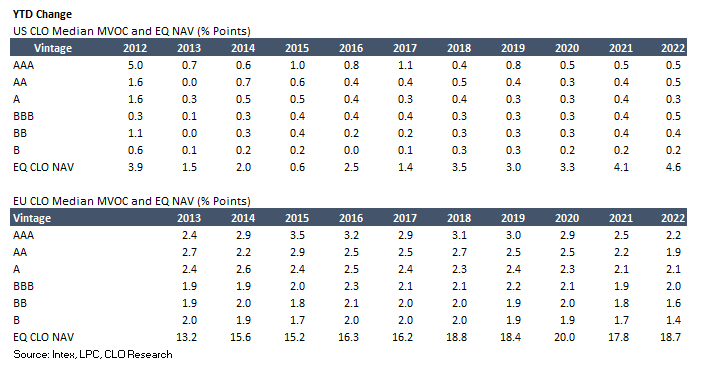

While the MVOC and Equity NAV metrics in the US CLO market have returned to levels observed at the beginning of 2023, the EU CLO market has still witnessed a decent gain year-to-date (though they started from a lower starting point in the beginning of 2023). This performance difference can potentially be viewed positively from a diversification standpoint for investors who have the ability to invest in both markets.

Regardless, market volatility is expected to persist in the CLO and loan markets, as evident in recent times. However, volatility can be both good and bad, depending on the circumstances. For example, it can provide opportunities for reinvesting CLO deals and for managers who can enhance the underlying collateral spreads without compromising on collateral quality. Conversely, volatility can also be a source of risk and uncertainty, which can further exacerbate issues already faced by some struggling seasoned CLO deals.

It is noteworthy that the optionality embedded in the long-term, non-recourse nature of the CLO capital structure can be a valuable feature for CLO equity investors. However, as mentioned in a previous article, 2023 will be a crucial year for CLO managers to demonstrate this value. This is no easy feat because in volatile markets with poor loan prices, prepayment rates are low, resulting in less cash available for redeployment into more compelling assets.

In conclusion, while the trends and metrics mentioned in this article provide a useful snapshot of the market at a given point in time, it is important to monitor and track deals’ and managers’ overall performance closely.

Disclaimers

The information, research, data, research-related opinions, observations, and estimates contained in this document have been compiled or arrived at by CLO Research Group, based upon sources believed to be reliable and accurate, and in good faith, but in each case without further investigation. None of CLO Research Group or its service providers; authorised personnel, or their directors make any expressed or implied presentation or warranty, nor do any of such persons accept any responsibility or liability as to the accuracy, timeliness, completeness, or correctness of such sources and the information, research, data, research related opinions, observations and estimates contained in this document. All information, research, data, research-related opinions, observations, and estimates in this document are in draft form as of the date of this document and remain subject to change and amendment without notice. Neither CLO Research Group nor any of their third-party providers shall be subject to any damages or liability for any errors, omissions, incompleteness, or incorrectness of this document. This article is not and should not be construed as an offer, or a solicitation of an offer, to buy or sell securities and shall not be relied upon as a promise or representation regarding the historical or current position or performance of any of the deals or issues mentioned in it.